|

theuae_left

|

The UAE - Economy

|

ECONOMY |

|

| |

Despite the fact that the UAE is now on a steady recovery trajectory, it was significantly impacted by the recent global economic crisis. Notwithstanding an initial cushion created by high oil prices, the Federation was eventually affected by the deepening global downturn that led to a slump in demand for oil, dragging prices to less than a third of their July 2008 peak. The reversal of a large influx of private capital led to a sharp downturn in stock-market indices. Furthermore, a decline in the construction and property sectors, mainstays of UAE economic expansion, meant that growth in 2009 was down sharply from previous years. In October 2009, the Ministry of Economy predicted growth of just 1.3 per cent for the year.

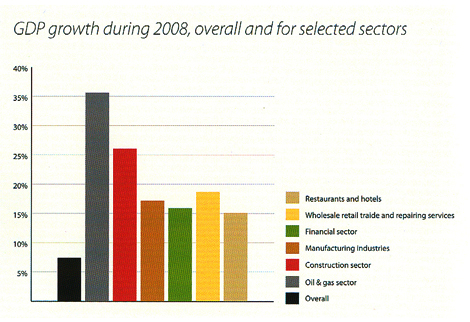

Figures for 2009 were in marked contrast with those for 2008, when growth in UAE gross domestic product (GDP) reached 7.4 per cent. Leading that rise was the oil and gas sector, which expanded by 35.6 per cent, due mainly to the increase in oil prices. Other strong growth sectors in 2008 included the construction industry (26.1 per cent), manufacturing industries (17.2 per cent), the financial sector (15.9 per cent), the wholesale retail trade and repair services (18.7 per cent), and the restaurant and hotel trade (15.1 per cent). |

| |

Trade

In 2008, the UAE’s trade balance increased by 35.3 per cent, from Dh170.85 billion (US$ 46.5 bn) in 2007 to Dh231.09 billion (US$62.9), due largely to a 33.9 per cent rise in the value of exports and re-exports and a 39.7 per cent rise in the value of oil exports, coupled with a 37.1 per cent increase in the value of gas exports.

Free trade zones saw a 16.4 per cent increase in exports, which reached Dh97.46 billion (US$26.6 bn) in 2008. Meanwhile, re-exports reached Dh 345.78 billion (US$94.2 bn); a rise of 33.4 per cent. Rising domestic demand due to increases in population and income levels, together with a positive growth in the re-export trade, helped push the value of imports up by 33.4 per cent to reach Dh735.70 billion (US$200.4 bn). |

|

| |

Inflation

Inflation in the first eleven months of 2009 stood at 1.7 per cent-down significantly from previous years. Lower housing prices and food costs contributed to deflationary pressures in the economy. In 2008, inflation stood at 10.8 per cent, as substantial revenues from higher oil prices fuelled economic growth, creating shortages of property and services. At the same time, the weaker US dollar and higher global food prices made imports more expensive. The UAE Central Bank’s stated policy has been to keep official interest rates at low levels in order to revive economic growth. |

|

| |

Industry and Diversification

The non-hydrocarbon sectors accounted for 63 per cent of GDP in 2008, despite high oil and gas prices, contributing Dh 2.16 trillion (US$ 590 bn) to the economy. The UAE is hoping to reduce the contribution of the hydrocarbons sector to approximately 20 per cent in the next ten to 15 years by promoting growth elsewhere in the economy.

Manufacturing and industry continue to be important components of the Federation’s ambitions for economic transformation, building on such already-thriving sectors as aluminum smelting, ceramics and pharmaceuticals.

In 2009, Abu Dhabi unveiled its 2030 Economic Vision, setting out a road map for greater economic diversification. Mubadala Development Company, the strategic investment arm of the Abu Dhabi Government, is paying a major role in the region’s industrial development, including projects in aerostructure (aircraft airframe components) manufacturing, commercial finance, energy and leisure. Abu Dhabi is also focusing on renewable sources of energy and the government-owned future energy company Masdar is a key part of this strategy. Masdar City, which the company describes as ‘the world’s first carbon-neutral zero-waste city and headquarters of the International Renewable Energy Agency (IRENA)’, will eventually house 40,000 residents and 50,000 daily commuters working at some 1500 green-energy firms. Masdar is also investing heavily in the fast-growing technology of thin-film solar energy panels, which includes the construction of a plant in Abu Dhabi capable of manufacturing enough panels each year to produce 130 megawatts.

Dubai, while restructuring some of its major state-backed companies, is continuing to build on its considerable strengths in industry, tourism and trade. Sharjah is also proceeding with plans for industrial development, and Ra’s al-Khaimah Investment Authority (RAKIA) is planning to launch a concept of themed industry zones to create clusters of manufacturing facilities. Fujairah is establishing a virtual free zone, the first in the UAE, which will let internationally owned companies do business for less than that charged by established free zones. In addition, the UAE Government is in the final stages of preparing an industrial law that is also expected to encourage the creation of national industries. |

|

| |

Real Estate

Several major projects were completed in 2009, one of the most impressive being Yas island, a leisure resort in Abu Dhabi and home to the Yas Marina circuit, which hosted the Formula One Grand Prix in November 2009. Major infrastructure schemes where completed, including the Dh28 billion (US$7.62 bn) Dubai Metro, the driverless transport system spanning the heart of the emirates; Sheikh Khalifa bridge, linking Abu Dhabi Island with Saadiyat and Yas Island; and the Palm Jumeriah Monorail. The tallest building in the world; the Burj Khalifa in Dubai, opened during the first week of 2010. |

|

| |

Tourism

Tourism is an important growth sector for the entire UAE economy. Abu Dhabi and Dubai have both gone through rebranding exercises, focusing on prime-quality hotels and leisure resorts. From the tropical island resort of Sir Bani Yas in western Abu Dhabi, the desert hideaways of Qasr al-Sarab, in the Liwa Oasis, and Al Maha and Bab al-Shams in Dubai to the well-sited coastal resorts of Fujairah, Ra’s al Khaimah and Ajman, the UAE offers superb facilities in some remote and beautiful locations. Flagship projects such as Emirates Palace Hotel, Burj al-Arab, Madinat Jumeirah, and the Bruj Khalifa have helped to raise the profile of the country, with the result that the Federation has much to offer even the most demanding of guests. Over 11.2 million visitors are expected in 2010, underpinning the success of the UAE’s attempts to boost investment in the hospitality industry. |

|

| |

Ease of Doing Business

In 2009, the UAE climbed fourteen places in the ‘Doing Business’ report compiled by the World Bank and its International Finance Corporation. The internationally recognized report assesses countries on how easy it is for small and medium-sized enterprises to conduct business. The Federation rose to thirty-third position in the global ranking for regulatory reform, partly as a result of the Government’s decision to abolish a Dh150,00 (US$40,871) minimum capital requirement for some start-up businesses.

Two other key reasons for the UAE’s rise was a streamlining of the process involved in obtaining construction permits and the improvement of capacity at Dubai ports. |

|

| |

Outward Investment

Investment in overseas markets has long been integral to the UAE’s strategic drive to create a security net for future generations, specifically those who one day face the prospect of depleted hydrocarbon reserves. Among the major international investment bodies in the Emirates are: the Abu Dhabi Investment Authority, Abu Dhabi Investment Council, Invest AD, The investment Corporation of Dubai, Dubai Holding, Dubai Holding Commercial Operations Group (including Dubai Properties Group, Sama Dubai, Tatweer, And Duabi Holding Investment Group), and Dubai World. In addition, Mubadala, the Abu Dhabi National Energy Company (Taqa) and the International Petroleum Investment Company (IPIC) pursue energy development abroad. |

|

| |

Financial Sector

Steps taken by federal institutions in 2008 to restore confidence in the financial system, including the UAE Central Bank Dh50-billion (US$13.6 bn) facility to support local lenders, and the UAE Ministry of Finance Dh70 billion (US$19 bn) liquidity support scheme, were designed to rekindle lending, buoy stock markets and give a boost to economic activity. In 2008, the Federal Government also announced that it would make up to Dh120 billion (US$32.7 bn) available to banks across the country under several lending programmes, and guarantee deposits and interbank lending for three years.

In February 2009, the Abu Dhabi Department of Finance injected Dh16 billion (US$4.35 bn) into five of the emirate’s biggest banks. These measures helped to firm up balance sheets at banks, although bank profits fell in the first quarter, and an emergency financial committee was set up by the Ministry of Economy to consider further actions to support lenders.

During the year, banks reported an increase in defaults and missed payments on commercial and consumer loans. As a result, the UAE’s listed banks took a cautious approach by reporting higher-than-usual provisioning against bad loans. To assist with extra capital-cushioning in the banking system, the Central Bank instructed lenders that from 2010 they must comply with Basel II regulations on capital adequacy for banks and pay more attention to risk-control and management. The Government also announced plans to merge the Emirates’ two biggest mortgage lenders, Amlak and Tamweel. This is considered pivotal to a recovery in the housing market.

The repayment of loans obtained from the market by government-owned conglomerates was also a focus of activity in 2009. In February 2009, the Government of Dubai sold Dh36.7 billion (US$10 bn) in bonds to the Central Bank to help companies in its control make debt payments and pay contractors. To oversee the distribution of these funds, the Dubai Financial Support Fund was established in July 2009. On 25 November 2009, the Dubai Government announced that it had lined up Dh18.4 million (US$5 bn) in financing from the National Bank Abu Dhabi and Al Hilal Bank, both of which are controlled by one of Abu Dhabi’s largest sovereign wealth funds, the Abu Dhabi Investment Council. Dubai also successfully managed a number of large debts in 2009, including a Dh12.47 billion (US$3.4 bn) refinancing of the exchange operator Borse Dubai’s debt in February, and the repayment of a Dh3.67 billion (US$1 bn) Dubai Civil Aviation Authority Islamic bond in November. |

|

| |

Stock Markets

Stocks listed on the Dubai Financial Market ended the year up 10.2 per cent, but were still more than 70 per cent down from the previous year’s highs. Stocks on the Abu Dhabi Securities Exchange rose by 14.7 per cent in 2009, but were still down 46 per cent from 2008 highs. |

|

| |

Oil and Gas

With a fraction of the land mass of some of its Gulf neighbours, the UAE is nonetheless the region’s fourth-largest exporter of crude oil, after Saudi Arabia, Iran and Iraq.

The UAE has the world’s sixth-largest proven reserves of conventional crude oil, and the seventh-largest proven reserves of natural gas. Although only the world’s nine-biggest oil producer, it is the fifth-largest net oil exporter, with only Russia and Saudi Arabia exporting substantially more. Its crude exports closely approach those of Iran, and Kuwait, which all have bigger reserves.

In 2009, due to exemplary compliance with the record production cuts pledged by the Organisation of the Petroleum Exporting Countries (OPEC) to stabilize oil markets, the UAE’s oil output fell to about 2.3 million barrels per day (bpd) from 2.9 million in 2008. It gas production stood at roughly 7 billion standard cubic feet per day. The UAE is pressing ahead with plans to expand oil and gas production capacity, but it has extended the time frame for oil development while giving higher priority to gas projects.

In early 2009 the Federation’s proven gas reserves stood at 227.1 trillion cubic feet – sufficient gas for more than 130 years of supply at recent production rates. Among other things, this means the Emirates’ gas shortage is not due to a lack of gas reserves, but to insufficient development, although many of the gas reserves are of a type that is costly and difficult to produce. Abu Dhabi is pivotal in boosting the UAE’s overall oil and gas production capacity, because it contains about 94 per cent of the Federation’s oil reserves and more than 90 per cent of its gas reserves. It is expanding capacity for both oil and gas production.

Meanwhile, Dubai’s oil production, which once accounted for about half that emirate’s GDP, has fallen dramatically from its 1991 peak of 410,000 bpd; by 2007 it had dropped to 80,000 bpd. While it continues to pump gas from offshore fields, Dubai also consumes more fuel than it produces, and it is increasingly dependent on imports to make up the difference. The emirate already purchases several hundred million cubic feet per day of gas from Dolphin Energy, an Abu Dhabi company that imports gas by pipeline from Qatar.

Four of the UAE’s remaining five emirates also have minor amounts of oil and gas production; Fujairah does not produce oil or gas, although an onshore exploration programme is currently under way. However, the world’s second-largest bunkering port is located on its coast. The port of Fujairah, on the Arabian Sea, handles about 1 million tonnes per month of marine transportation fuel and other oil products. The arrival in 2008 of gas imports through the Dolphin Energy pipeline from Qatar has facilitated power and water development in the emirate and stimulated local industry.

IPIC, owned by the Abu Dhabi Government, is building a strategic crude-oil pipeline to deliver up to 150,000 bpd of oil from Abu Dhabi’s onshore fields o a new export terminal in Fujairah. The project aims to supply an export route for Abu Dhabi crude bypasses the Gulf’s maritime choke point at the Strait of Hormuz. It is scheduled for completion in 2010, with the first tanker shipment from Fujairah expected in early 2011. IPIC is also developing an oil refinery and storage facilities at the Fujairah port. |

|

| |

| Source: UAE2010 Yearbook - UAE National Media Council |

| |

|

|

|

|

theuae_right

|